Estratégia Financeira

Part 6 - ch.24 Debt Financing

23-04-2025

Chapter Outline

24.1 Corporate Debt

24.2 Other Types of Debt

24.3 Bond Covenants

24.4 Repayment Provisions

24.1 Corporate Debt

24.1 Corporate Debt

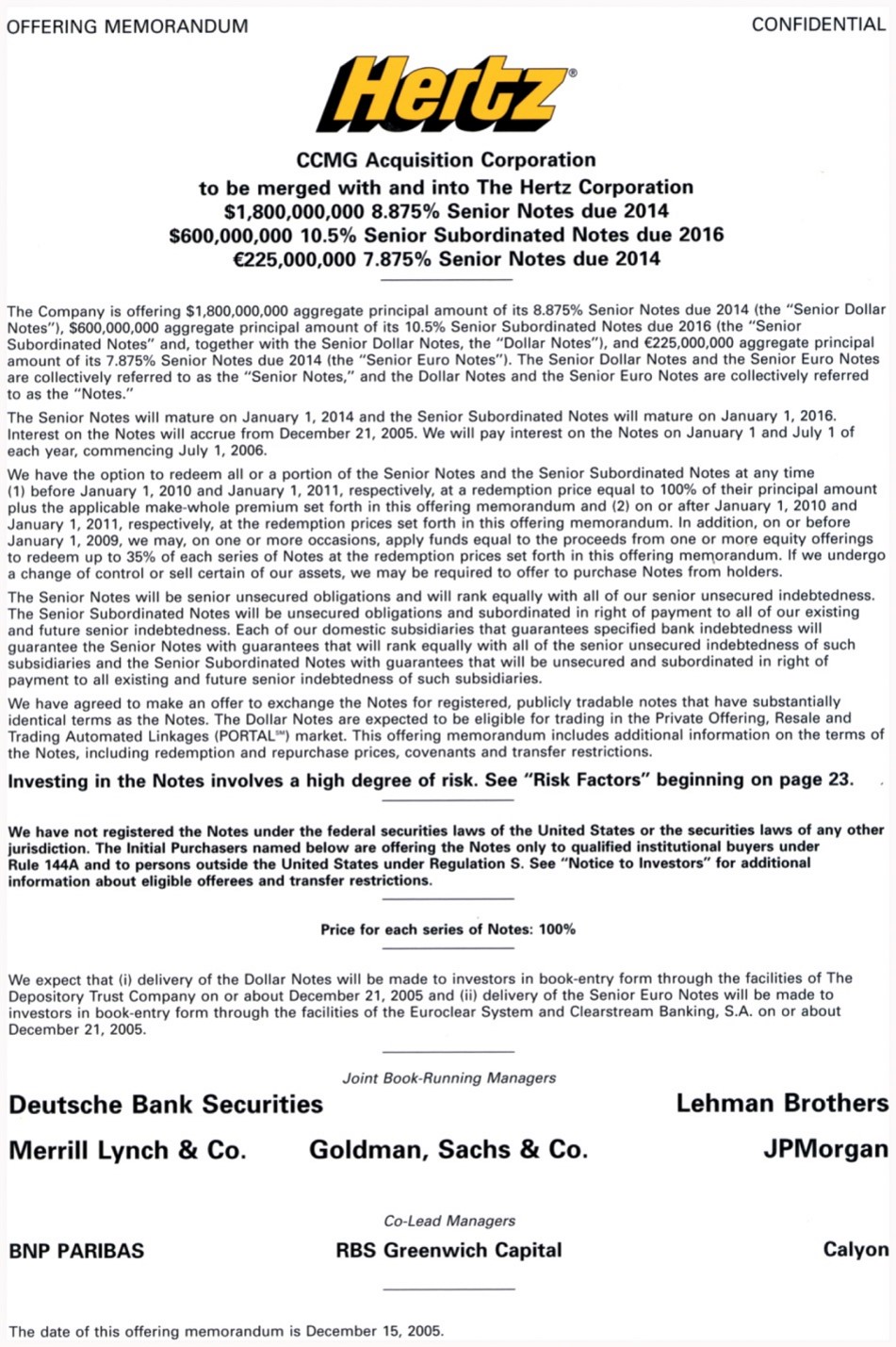

Public debt

The Prospectus: A public bond issue is similar to a stock issue.

- Indenture

- Included in a prospectus, it is a formal contract between a bond issuer and a trust company.

- The trust company represents the bondholders and makes sure that the terms of the indenture are enforced.

- In the case of default, the trust company represents the interests of the bond holders.

24.1 Corporate Debt

Public debt

- Corporate bonds almost always pay coupons semiannually, although a few corporations have issued zero-coupon bonds.

- Most corporate bonds have maturities of a few years.

- The face value or principal amount of a bond is denominated most often as $1000.

- The face value does not always correspond to the actual money raised because of underwriting fees and/or if the bond is issued at a discount.

- Original Issue Discount Bond (OID)

- Describes a bond that is issued at a discount

24.1 Corporate Debt

Registered Bonds

- The issuer of this type of bond maintains a list of all holders of its bonds.

- Bonds are registered at CVM & SEC for listed companies.

- Private companies do not issue bonds usualy.

- Coupon and principal payments are made only to people on this list.

- Almost all bonds today are registered bonds.

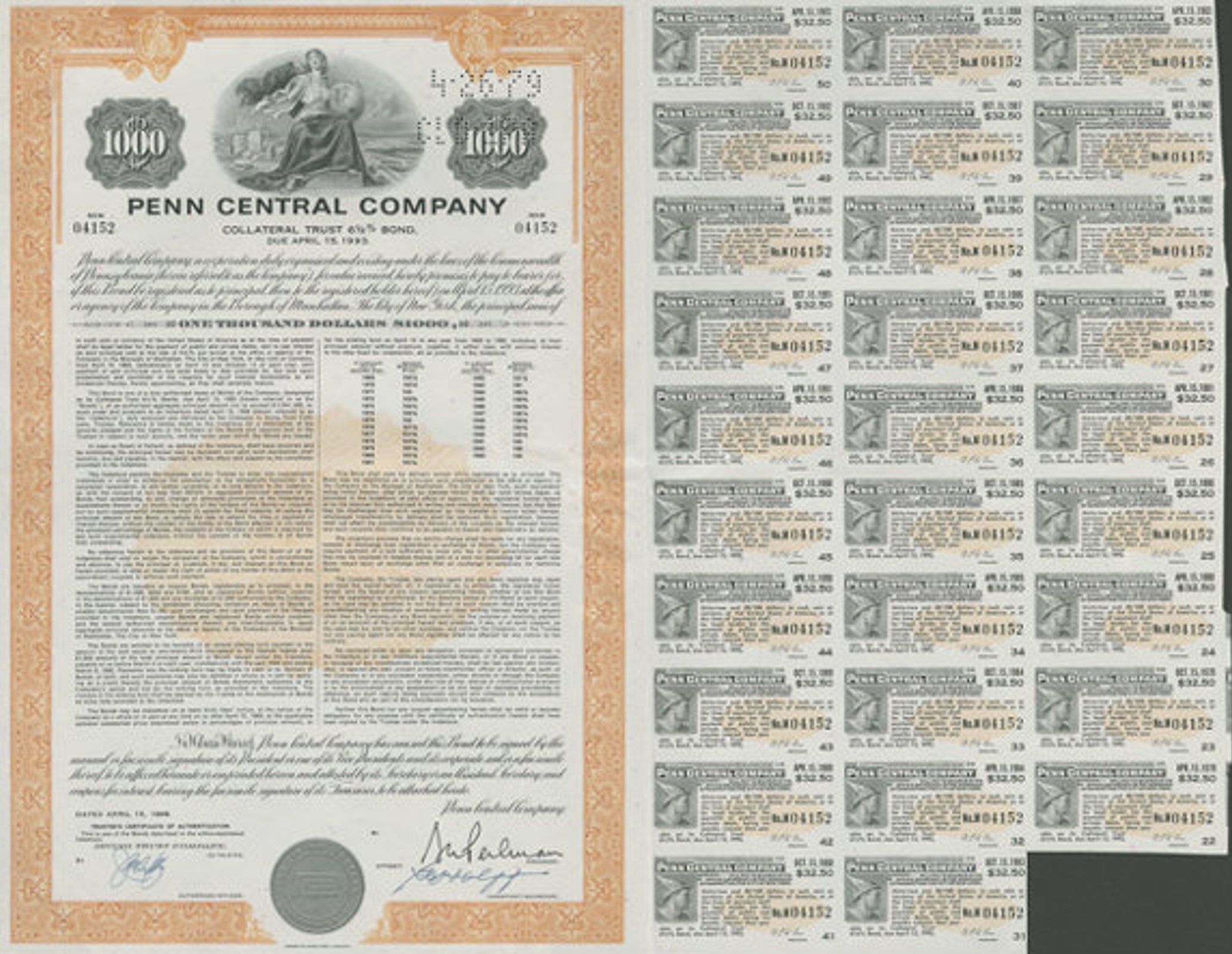

Bearer Bonds:

- Similar to currency: whoever physically holds the bond certificate owns the bond.

- To receive a coupon payment, the holder of a bearer bond must provide explicit proof of ownership by literally clipping a coupon off the bond certificate and remitting it to the paying agent.

- It used to be literally a piece of paper.

24.1 Corporate Debt

24.1 Corporate Debt

Unsecured Debt: A type of corporate debt that, in the event of bankruptcy, gives bondholders a claim to only the assets of the firm that are not already pledged as collateral on other debt.

Examples:

- Notes: Notes typically are coupon bonds with maturities shorter than 10 years.

- Debentures: Debentures typically have longer maturities than notes.

Secured Debt: A type of corporate debt in which specific assets are pledged as collateral.

- Mortgage Bonds: Real property is pledged as collateral that bondholders have a direct claim to in the event of bankruptcy. They are paid with the cash flow source generated by the asset.

- Asset-Backed Bonds (ABS): Specific assets are pledged as collateral that bondholders have a direct claim to in case of bankruptcy. Can be any kind of asset.

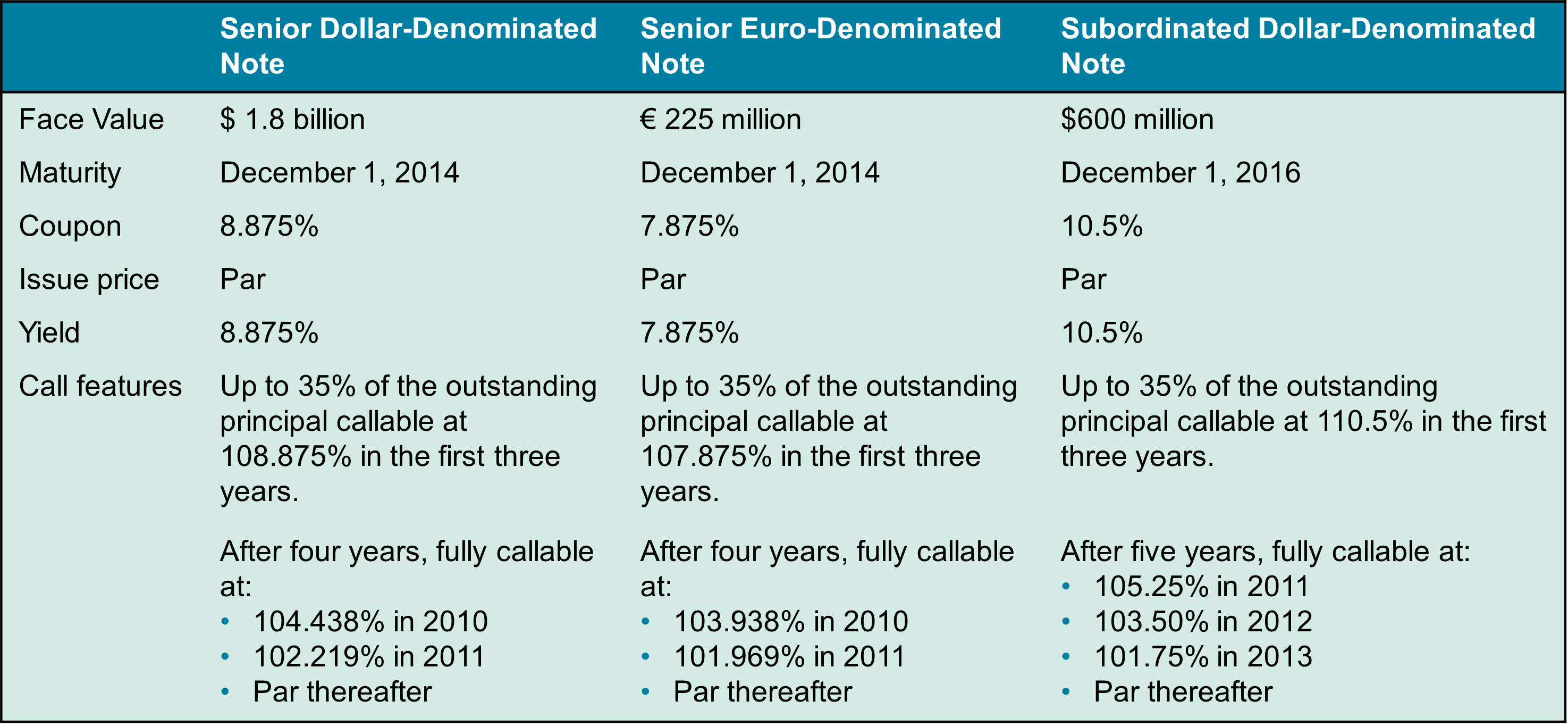

24.1 Corporate Debt

Tranches: Different classes of securities that comprise a single bond issue.

Issue price: par (it means that the bond has been issued at face value).

24.1 Corporate Debt

Seniority

- A bondholder’s priority in claiming assets not already securing other debt.

- Most debenture issues contain covenants restricting the company from issuing new debt with equal or higher priority than existing debt.

Subordinated Debentures: Debt that, in the event of a default, has a lower priority claim to the firm’s assets than other outstanding debt.

Senior Debentures: Debt that, in the event of a default, has a higher priority claim to the firm’s assets than other outstanding debt.

24.1 Corporate Debt

Bond Markets & International Bonds

Domestic Bonds: Bonds issued by a local entity and traded in a local market, but purchased by foreigners. They are denominated in the local currency.

Foreign Bonds: Bonds issued by a foreign company in a local market and intended for local investors. They are denominated in the local currency.

- Yankee Bonds: Foreign bonds in the United States

- Samurai Bonds: Foreign bonds in Japan

- Bulldogs: Foreign bonds in the United Kingdom

- Eurobonds: International bonds that are not denominated in the local currency of the country in which they are issued. The trading is not subject to any particular nation’s regulation.

- Global Bonds: Bonds that are offered for sale in several different markets simultaneously. Global bonds can be offered for sale in the same currency as the country of issuance (unlike Eurobonds).

24.1 Corporate Debt

Private Debt: Debt that is not publicly traded. Has the advantage that it avoids the cost of registration but has the disadvantage of being illiquid.

Loans: A bank loan that lasts for a specific term.

- Syndicated Bank Loan: A single loan that is funded by a group of banks rather than just a single bank.

- Line of Credit: A credit commitment for a specific time period, typically two to three years, which a company can use as needed.

- Private Placements: A bond issue that is sold to a small group of investors rather than the general public.

- Because a private placement does not need to be registered, it is less costly to issue than public debt.

24.2 Other Types of Debt

24.2 Other Types of Debt

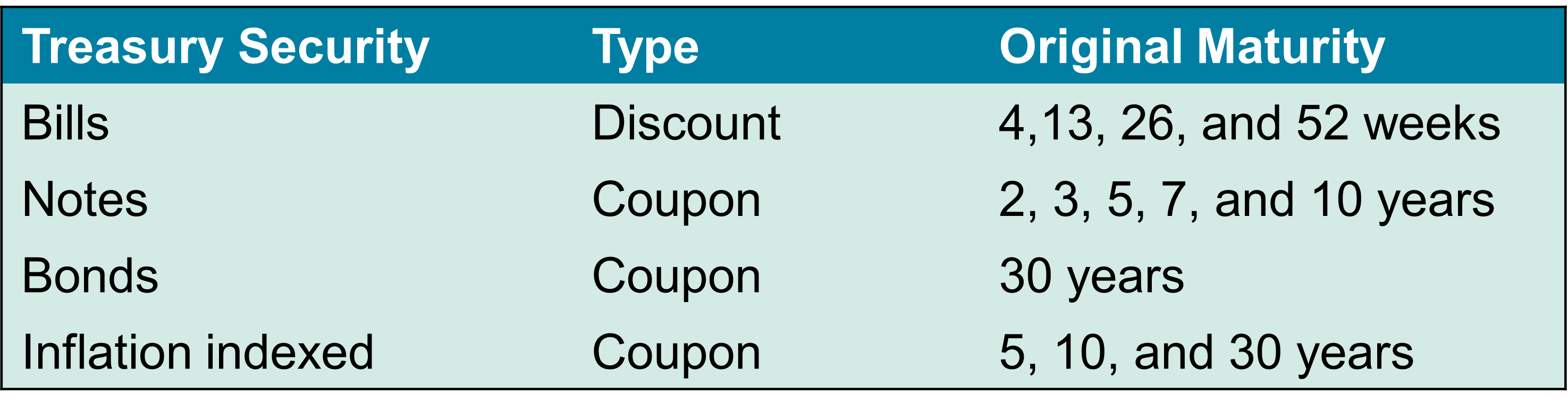

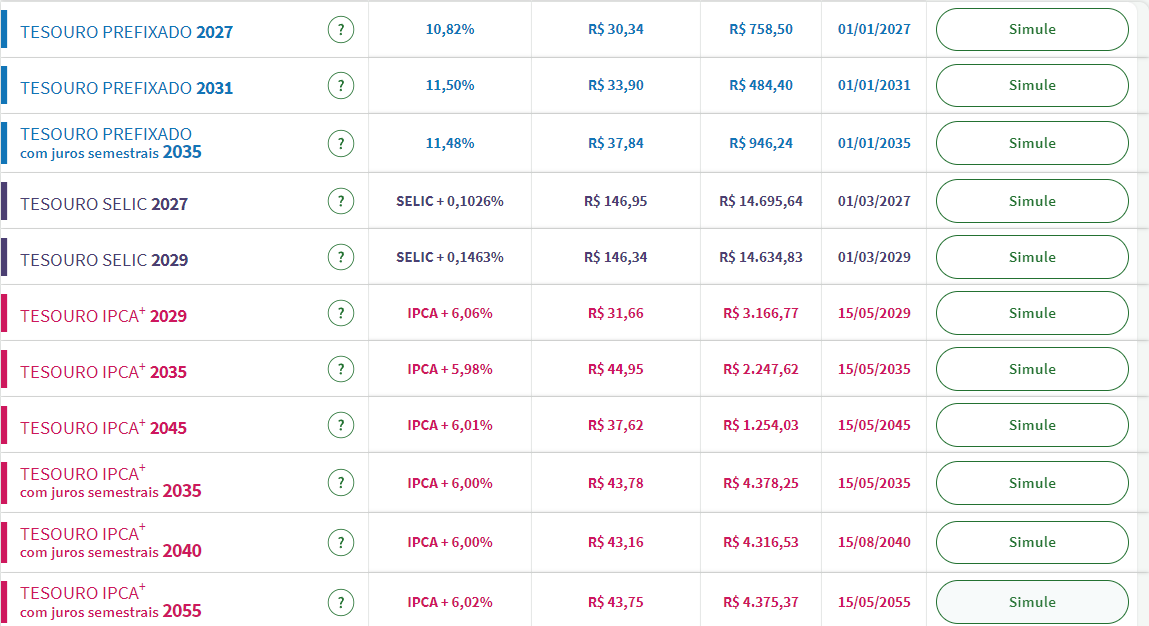

Sovereign Debt: Debt issued by national governments. U.S. Treasury securities represents the single largest sector of the U.S. bond market. The same is true un Brazil.

Treasury-Inflation-Protected Securities are called TIPS.

24.2 Other Types of Debt

Municipal Bonds (Munis)

- Bonds issued by state and local governments.

- They are not taxable at the federal level (and sometimes at the state and local level as well).

- Sometimes referred to as tax-exempt bonds.

- Not common in Brazil.

24.2 Other Types of Debt

Asset-Backed Securities (ABS)

- Securities made up of other financial securities. Security’s cash flows come from the cash flows of the underlying financial securities that “back” it.

Asset Securitization: The process of creating an asset-backed security.

Mortgage-Backed Security: Largest ABS market. Backed by home mortgages. Often they are guaranteed against default risk by the U.S. government.

- When homeowners in the underlying mortgages make their mortgage payments, this cash goes (minus servicing fees) to the holders of the mortgage-backed security, e.g., usually banks.

24.3 Bond Covenants

24.3 Bond Covenants

Restrictive clauses in a bond contract that limit the issuers from undercutting their ability to repay the bonds.

For example, covenants may:

- Restrict the ability of management to pay dividends

- Restrict the level of further indebtedness

- Specify that the issuer must maintain a minimum amount of working capital

There are: positive and negative covenants

Positive: the firm must do something (keep specific financial ratios, pay taxes and other obligations, etc)

Negative: the firm must not do something (sell specific assets, pay too much dividend, etc)

Covenants are a common feature of bonds.

24.4 Repayment Provisions

24.4 Repayment Provisions

A bond issuer typically repays its bonds by making coupon and principal payments as specified in the bond contract. However, the issuer can:

- Repurchase a fraction of the outstanding bonds in the market.

- Make a tender offer for the entire issue.

- Exercise a call provision.

Callable Bonds: Bonds that contain a call provision that allows the issuer to repurchase the bonds at a predetermined price.

Call provisions: Allows the issuer of the bond the right (not obligation) to retire all outstanding bonds on (or after) a specific date, for the call price. The call price is generally set at or above, and expressed as a % of face value (e.g..102% of face value).

- A firm may choose to call a bond issue if interest rates have fallen.

- The issuer can lower its borrowing costs by exercising the call on the callable bond and then immediately refinancing the issue at a lower rate.

24.4 Repayment Provisions

Callable Bonds

- Holders of callable bonds understand that the issuer will exercise the call option only when the coupon rate of the bond exceeds the prevailing market rate.

- If a bond is called, investors must reinvest the proceeds when market rates are lower than the coupon rate they are currently receiving.

- This makes callable bonds relatively less attractive to bondholders than identical non-callable bonds.

- A callable bond will trade at a lower price (and therefore a higher yield) than an otherwise equivalent non-callable bond.

24.4 Repayment Provisions

Sinking Fund

A method of repaying a bond in which a company makes regular payments into a fund administered by a trustee over the life of the bond.

These payments are then used to repurchase bonds.

This allows the firm to retire some of the outstanding debt without affecting the cash flows of the remaining bonds.

The trust can either repurchase the bonds in the market (if the price is below the face value) or by lottery at the par (if the price is above face value).

24.4 Repayment Provisions

Convertible Bond: A corporate bond with a provision that gives the bondholder an option to convert each bond owned into a fixed number of shares of common stock.

Conversion Ratio: The number of shares received upon conversion of a convertible bond, usually stated per $1000 of face value.

Conversion Price: The face value of a convertible bond divided by the number of shares received if the bond is converted.

- Assume a convertible bond with a $1000 face value and a conversion ratio of 15.

- If you convert the bond into stock, you will receive 15 shares.

- If you do not convert, you will receive 1000.

- By converting you essentially “pay” 1000 for 15 shares, implying a price per share of 66.67.

- If the price of the stock exceeds 66.67, you will choose to convert; otherwise, you will take the cash.

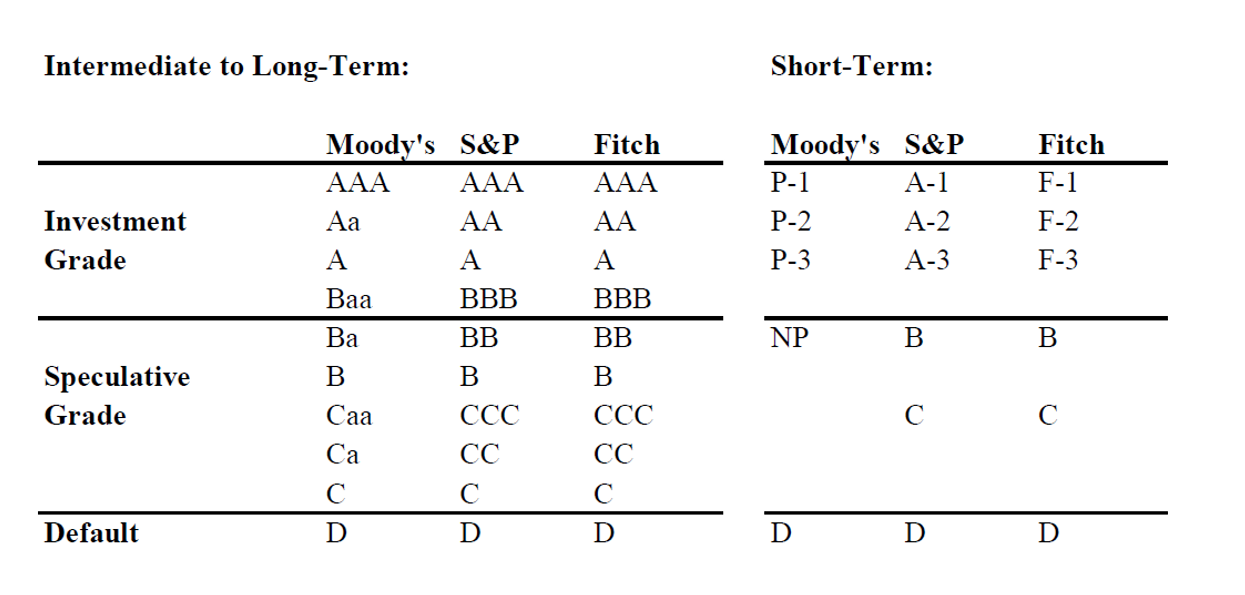

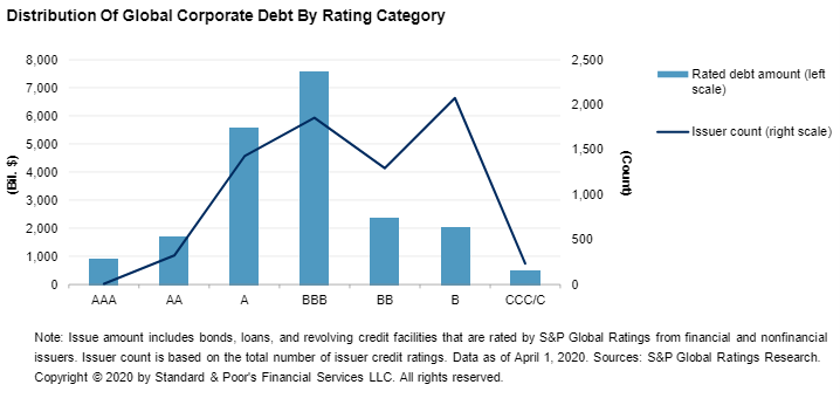

Ratings

Ratings

A credit rating is an opinion of the general creditworthiness of either an issuer or one of the specific issues made by the issuer.

These opinions represent the default risk of a security.

There are many factors that affect a credit rating.

- Industry-level factors

- Firm-level factors

- Security-level factors

- Firm’s financial analysis and quality

- Etc.

Ratings

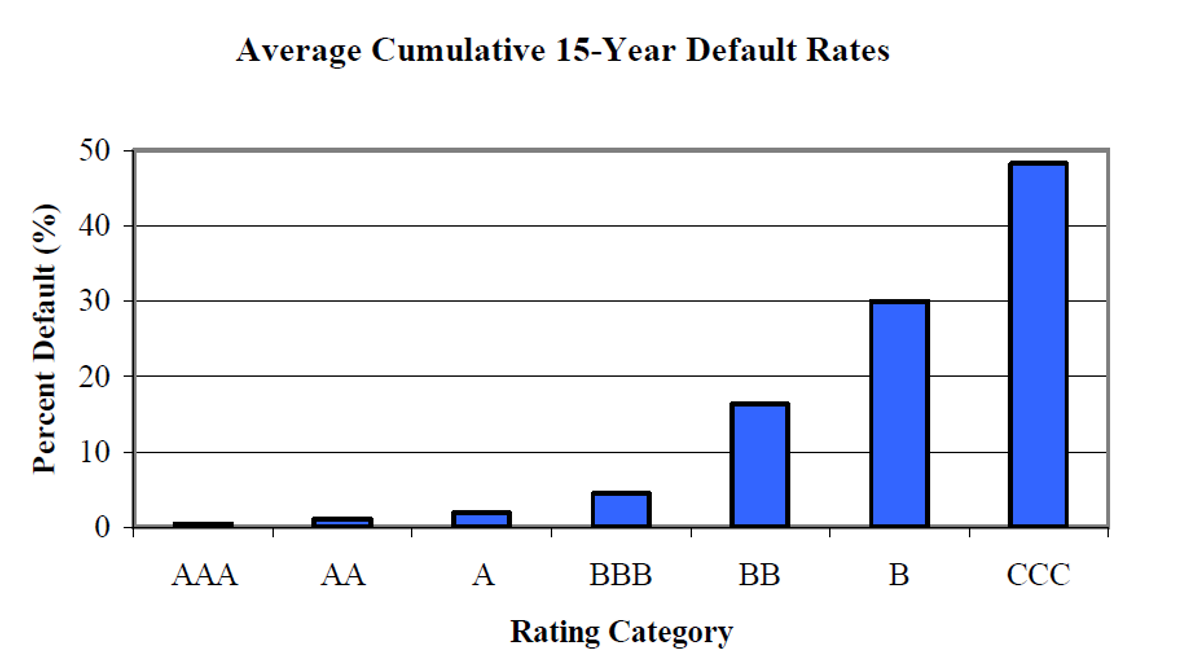

Ratings are constructed to represent the risk of default.

- A high (low) rating implies a low (high) probability of default.

- Default refers to any event that results in the issuer’s breaching its financial contract.

- Minor default: failing to meet a contracted financial ratio.

- Serious default: failure to make an interest or principal payment.

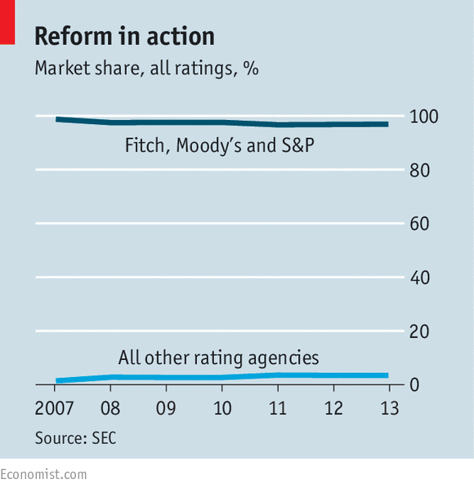

Ratings

Three main players:

- Moody’s

- Standard & Poor’s

- Fitch

They make money:

- “Selling” a rating:

- Selling softwares to access information.

There is an idea that “not having a rating is worse than having poor rating”.

Do you agree?

Short video: The Big Short.

Ratings

Investment grad ~= Speculative grade ~= Default.

Ratings Link

Ratings

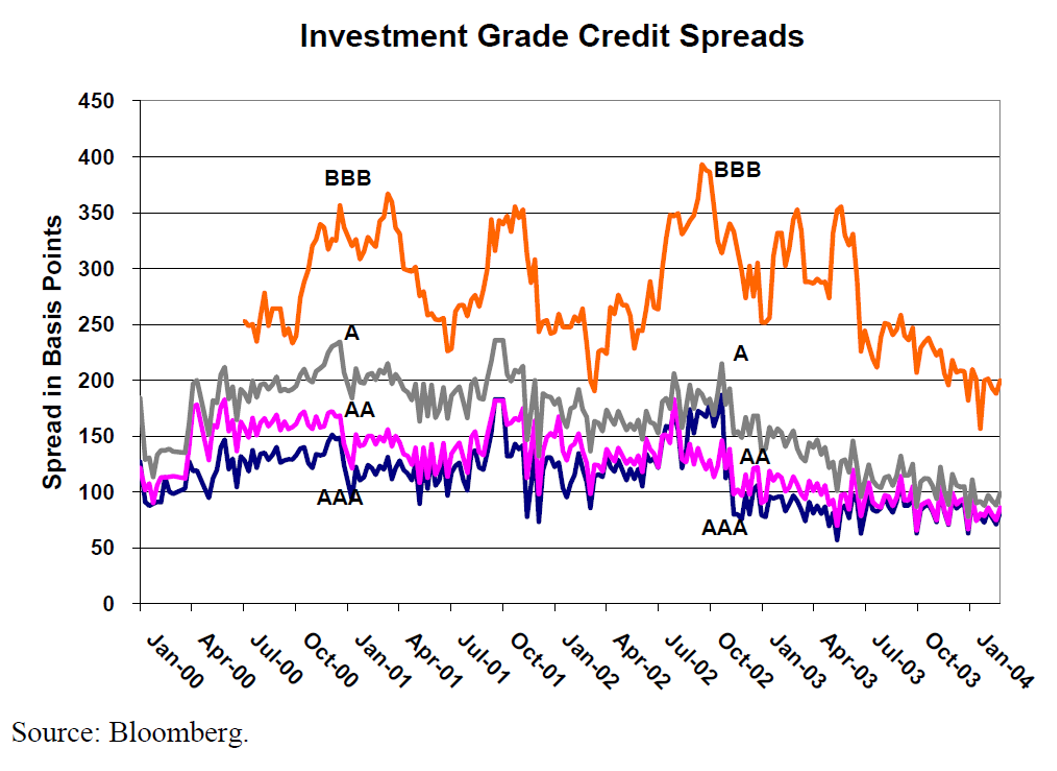

Ratings and the cost of capital

The Rating process

- Rating agency meets with company management (CFO & CEO).

- A team of analysts is assigned to the transaction to review the offering documents, financial statements, the terms of the proposed offering, use of proceeds, historical and pro forma financial analysis, competitive analysis, capital-expenditure plans, etc.

- A recommendation is made to an internal rating committee that votes on the proposed rating.

- The company is notified and allowed to respond before the rating is released to the media. The company has the opportunity to appeal and present additional data supporting a higher rating.

- A rating is often assigned within two weeks.

- After the final rating is assigned, analysts track the company’s performance and adjusts the rating over time.

- The rating agency typically conducts formal quarterly reviews and meets with management at least once annually.

Now it is your turn…

Practice

Remember to solve:

Interact

THANK YOU!

QUESTIONS?

Henrique C. Martins

[Henrique C. Martins] [henrique.martins@fgv.br] [Teaching Resources] [Practice T/F & Numeric] [Interact][Do not use without permission]