Estratégia Financeira

Part 0

31-01-2025

Introduction

Introduction

Today:

- Introduction to the course

- Discussion about the Syllabus

- Performance assessment

- Initial discussion about finance

- First Chapter

Description

The purpose of the course is to familiarize students with the concepts and techniques related to the analysis and strategic decisions in the areas of investment and financing in a risky environment, always with the purpose of maximizing the company’s value.

At the end of the semester, the student should be able to master the:

- concepts of analysis, measurement, and applications of cost and capital structure,

- including strategies regarding portfolios

- earnings distribution policy,

- finding firm value.

To Midterm:

Ch 23: Raising Equity Capital

Ch 10: Capital Markets and the Pricing of Risk

Ch 11: Optimal Portfolio Choice and the Capital Asset Pricing Model

Ch 12: Estimating the Cost of Capital

Ch 13: Investor Behavior and Capital Market Efficiency

To final:

Ch 24: Debt Financing

Ch 14: Capital Structure in a Perfect Market

Ch 15: Debt and Taxes

Ch 16: Financial Distress, Managerial Incentives, and Information

Ch 17: Payout Policy

Setting expectations

Your mission (should you choose to accept it…)

Read the book before class (preferably more than once).

Solve all the problems.

Ask questions.

- This is the best way to learn. I will ask questions all the time during class. I expect that you answer them.

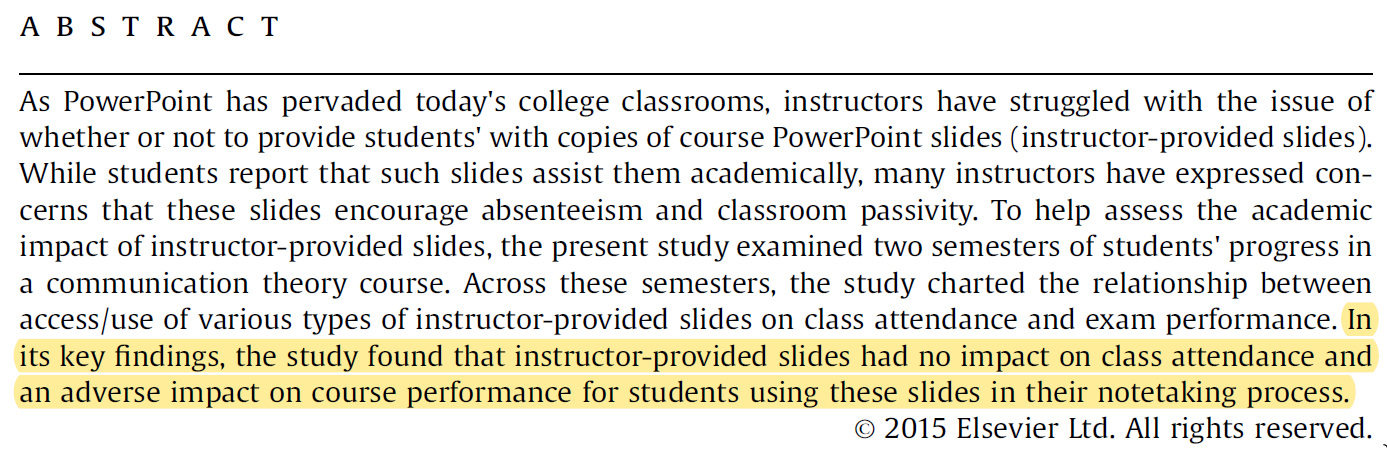

Make notes (with your hand, not your computer)

- Research shows that taking notes boosts academic performance.

- It is better to take a note and throw it away than to take a note on your computer.

Resources

Worthington, D. L., & Levasseur, D. G. (2015). To provide or not to provide course PowerPoint slides? The impact of instructor-provided slides upon student attendance and performance. Computers & Education, 85, 14-22.

BERK, Jonathan, DeMARZO, Peter. Corporate Finance, Global Edition. 5th edition, Boston, MA: Pearson, 2019. https://amzn.to/3jl9YPl

Performance assessment

1 Midterm Exam: 40%

2 Final Exam: 40%

3 Activities: 20%

- Competition (at least 10% out of 20%)

- Quizzes and “Monitored activity”

- Participation

Read the Syllabus

How to study? (Source)

How to study? (Source)

How to study? (Source)

How to study? (Source)

How to study? (Source)

How to study? (Source)

Warming up…

Warming up…

What is Finance?

What is missing?

What is Finance?

Which of these answers is better?

Finance is a time machine

Finance is an applied science that deals with the allocation of scarce resources over time under conditions of uncertainty. (Source)

Now it is your turn…

Practice

This is an introductory part. You can start preparing yourself by checking the following lists of problems.

This is for Part 1 (ch24):

If you have any questions, ask next slide.

Interact

THANK YOU!

QUESTIONS?

Henrique C. Martins

[Henrique C. Martins] [henrique.martins@fgv.br] [Teaching Resources] [Interact][Do not use without permission]