Estratégia Financeira

Module 0

31-01-2026

Introduction

Introduction

Today:

- Introduction to the course

- Discussion about the Syllabus

- Performance assessment

- Initial discussion about finance

- First Chapter

Description

The purpose of the course is to familiarize students with the concepts and techniques related to the analysis and strategic decisions in the areas of investment and financing in a risky environment, always with the purpose of maximizing the company’s value.

At the end of the semester, the student should be able to master the:

- concepts of analysis, measurement, and applications of cost and capital structure,

- including strategies regarding portfolios

- earnings distribution policy,

- finding firm value.

To Midterm:

Ch 23: Raising Equity Capital

Ch 10: Capital Markets and the Pricing of Risk

Ch 11: Optimal Portfolio Choice and the Capital Asset Pricing Model

Ch 12: Estimating the Cost of Capital

Ch 13: Investor Behavior and Capital Market Efficiency

To final:

Ch 24: Debt Financing

Ch 14: Capital Structure in a Perfect Market

Ch 15: Debt and Taxes

Ch 16: Financial Distress, Managerial Incentives, and Information

Ch 17: Payout Policy

Setting expectations

Your mission (should you choose to accept it…)

Read the book before class (preferably more than once).

Solve all the problems.

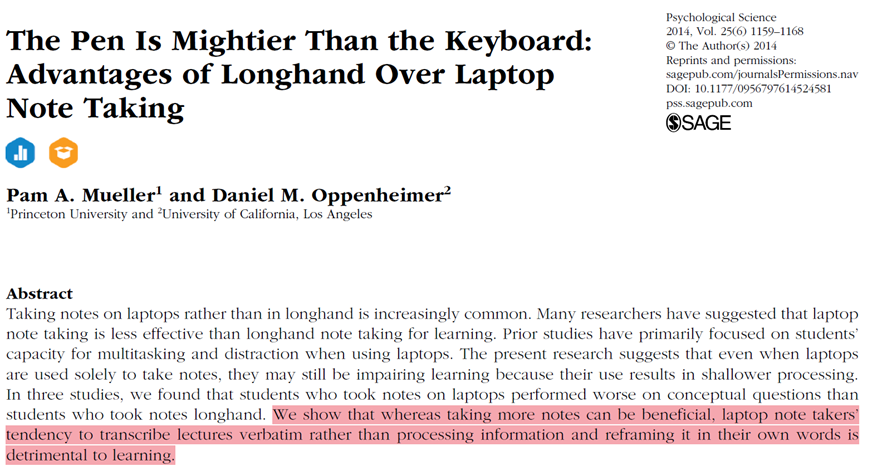

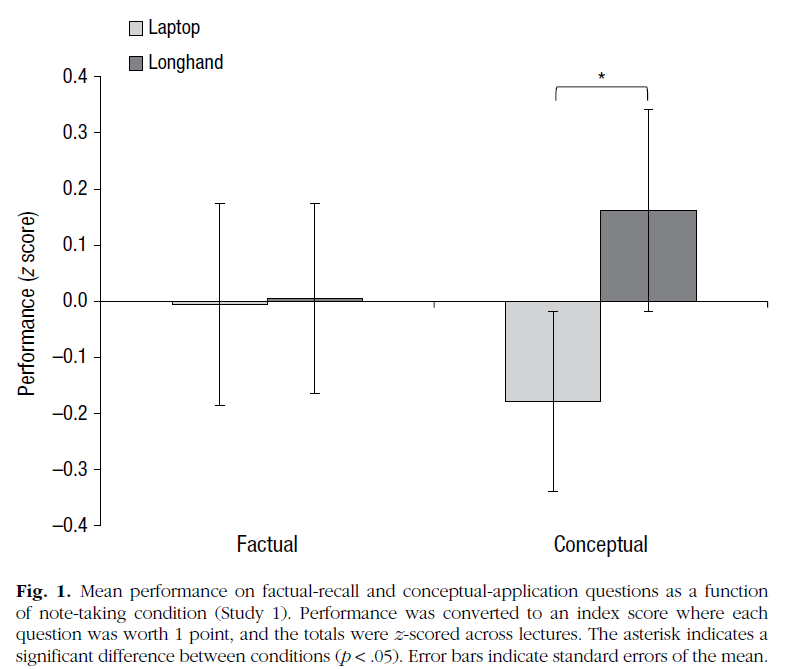

Make notes (with your hand, not your computer)

- Research shows that taking notes boosts academic performance.

- It is better to take a note and throw it away than to take a note on your computer.

Ask questions.

- This is the best way to learn. I will ask questions all the time during class. I expect that you answer them.

New rules 2026/01

Art. 31º - Não existe abono de falta, mesmo que por razões justificadas, visto que o aluno tem o direito de faltar em até 25% das aulas oferecidas sem a necessidade de qualquer justificativa ou comprovação.

Exemplos:

- situações familiares, problemas de saúde, problemas com pets, etc.

Exceções:

- Guarda religiosa

- Chamados judiciais/serviço militar

- Seleções esportivas oficiais do país

New rules 2026/01

Assim, a partir do 1o/2026, no caso de falta por Guarda Religiosa, o professor solicitará ao aluno uma “prestação alternativa” (termo mencionado na Lei 13.796, que trata da Guarda Religiosa).

- Esta “prestação alternativa” tem a função de reduzir o prejuízo pedagógico que o aluno teve devido à sua falta na aula (por exemplo, indicação e conferência de leitura, exercícios dirigidos etc., sempre compatível com o conteúdo efetivamente perdido daquela aula).

- A falta será efetivamente abonada pelo professor após o aluno cumprir sua “prestação alternativa”, dentro de um prazo previamente combinado com o professor.

New rules 2026/01

- 7/4 (after 17h), 8/4 (all day), 9/4 (all day),

- 21/5 (after 17 h),

- 22/5 (all day)

- every Friday (after 17h),

- evey Saturday.

New rules 2026/01

There is no Reaval anymore

- Instead, you can ask for a Recuperação

- Still 5,00 to 5,99

- Exams of summer/winter courses

- You can follow the classes of summer/winter courses

New rules 2026/01

Stricter penalties for problems during exams

- Weeks/Months of penaly

BERK, Jonathan, DeMARZO, Peter. Corporate Finance, Global Edition. 5th edition, Boston, MA: Pearson, 2019. https://amzn.to/3jl9YPl

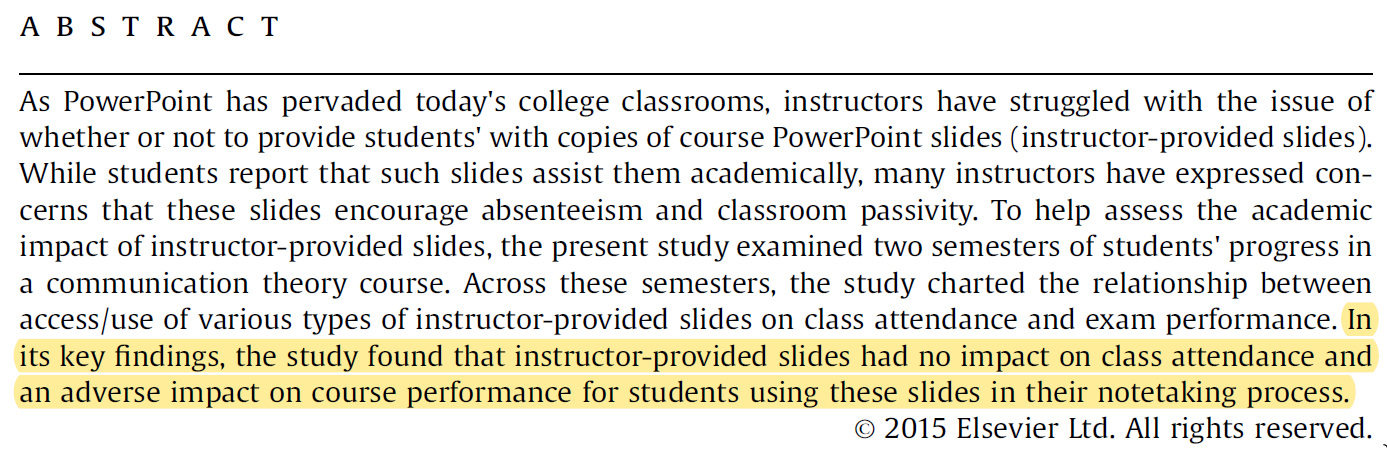

About notes

Worthington, D. L., & Levasseur, D. G. (2015). To provide or not to provide course PowerPoint slides? The impact of instructor-provided slides upon student attendance and performance. Computers & Education, 85, 14-22.

About notes

About notes

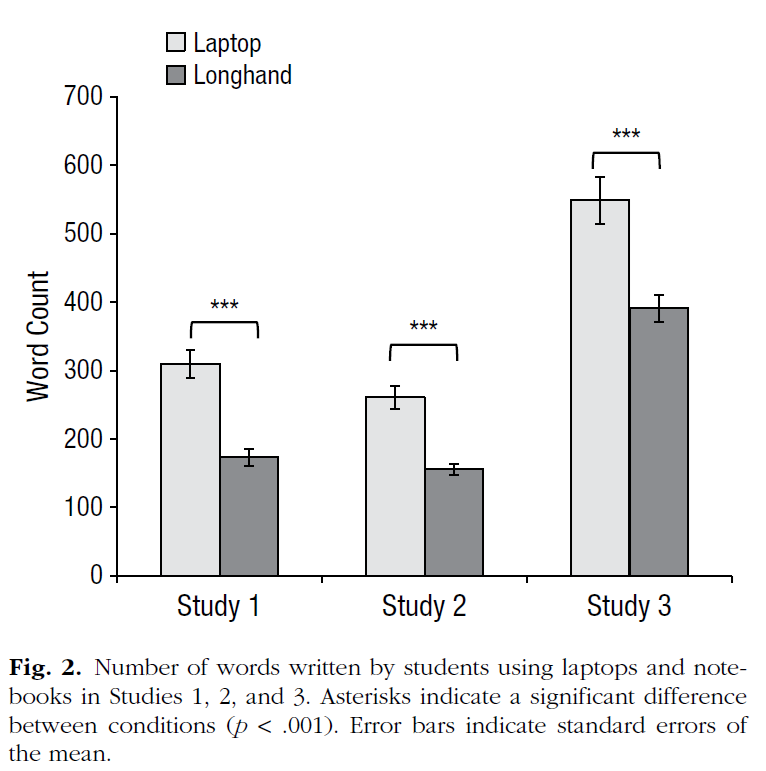

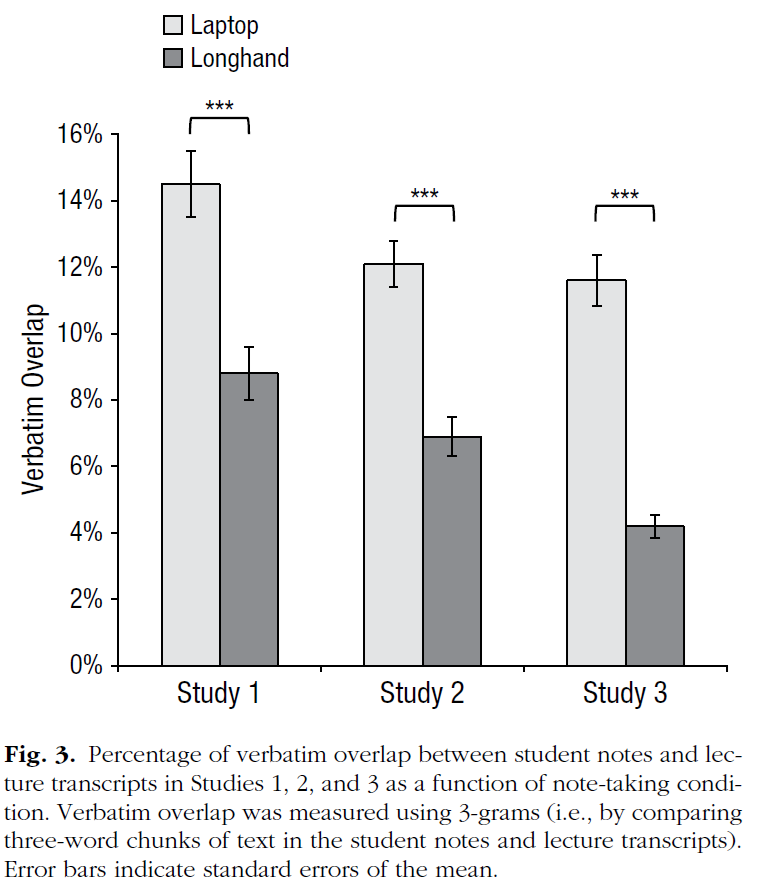

Participants were 67 students (33 male, 33 female, 1 unknown) from the Princeton University subject pool.

We selected five TED Talks (for length (slightly over 15 min) and to cover topics that would be interesting but not common knowledge. Laptops had full-size (11-in. × 4-in.) keyboards and were disconnected from the Internet.

Participants watched the lecture.

Next, participants were taken to a lab; they completed two 5-min distractor tasks and engaged in a taxing working memory task

Finally, participants responded to both factual-recall questions (e.g., “Approximately how many years ago did the Indus civilization exist?”) and conceptual-application questions (e.g., “How do Japan and Sweden differ in their approaches to equality within their societies?”) about the lecture and completed demographic measures.

About notes

About notes

Performance assessment

1 Midterm Exam: 40%

2 Final Exam: 40%

3 Activities: 20%

- Quizzes and “Monitored activity”

- Participation

Read the Syllabus

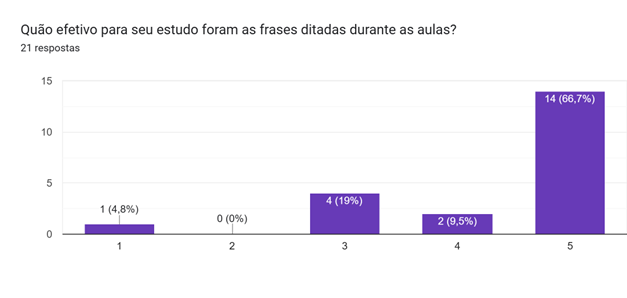

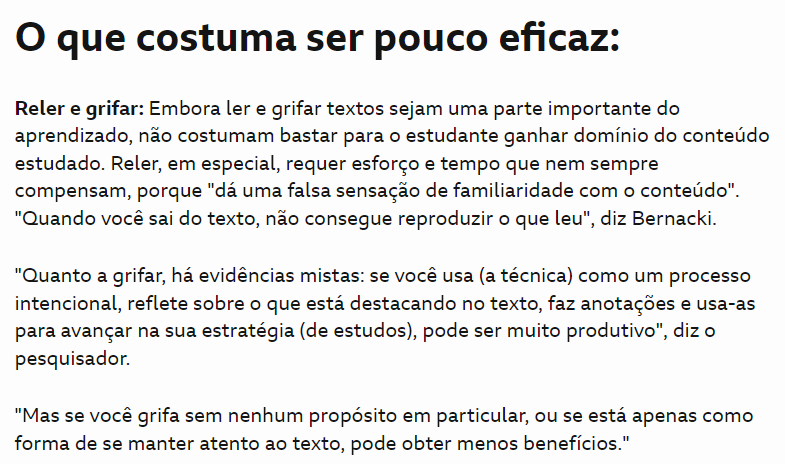

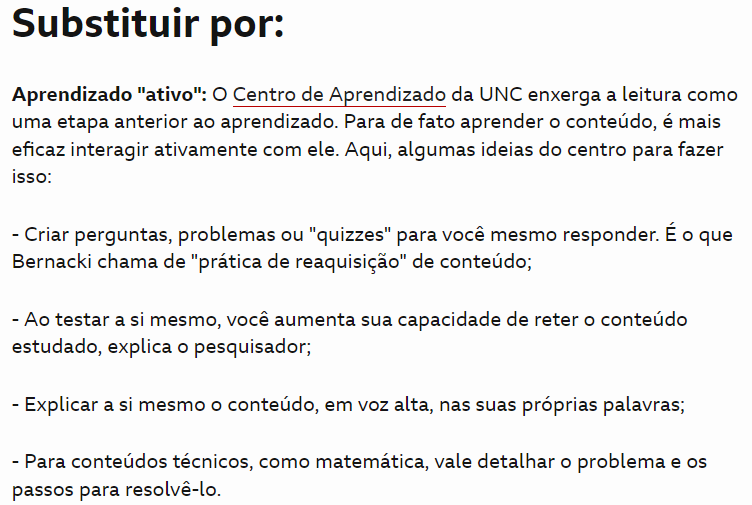

How to study? (Source)

How to study? (Source)

How to study? (Source)

How to study? (Source)

How to study? (Source)

Warming up…

Warming up…

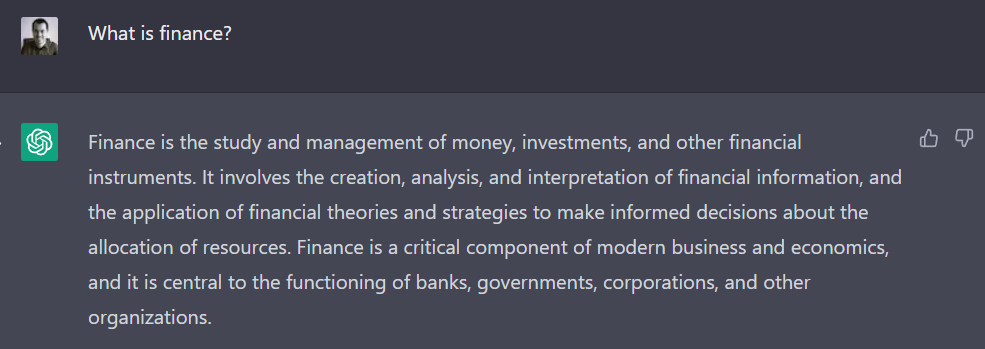

What is Finance?

What is missing?

What is Finance?

Which of these answers is better?

Finance is a time machine

Finance is an applied science that deals with the allocation of scarce resources over time under conditions of uncertainty. (Source)

🙋♂️ Any Questions?

Thank You!

👤 Henrique C. Martins

- 🌐 FGV/EAESP

- 💼 LinkedIn

- 🧠 Google Scholar

- 📄 Lattes CV

- 🏠 Personal Website

[Henrique C. Martins] [Teaching Resources][Do not use without permission]